Achieve Your Financial Goals with a Printable Template

What are Financial Goals?

Financial goals are specific, measurable objectives you set for managing your money and achieving desired financial outcomes. They provide direction for your financial decisions and actions, helping you allocate resources effectively to improve your financial well-being over time.

Why are Financial Goals Important?

Financial goals are important for several reasons:

- Direction and focus: They give you a clear path to follow with your money management.

- Motivation: Having concrete goals can inspire you to make better financial choices.

- Measurable progress: Goals allow you to track your advancement and celebrate milestones.

- Prioritization: They help you allocate resources efficiently based on what matters most to you.

- Long-term planning: Goals encourage thinking beyond immediate needs to secure your financial future.

- Reduced stress: Clear objectives can alleviate anxiety about money by providing a sense of control.

What Types of Financial Goals Can You Set?

Financial goals typically fall into three main categories based on their time horizon:

Short-term goals (under 1 year):

- Building an emergency fund

- Paying off small debts

- Saving for a vacation

- Making minor home improvements

Medium-term goals (1-5 years):

- Saving for a down payment on a house

- Paying off larger debts (e.g., student loans)

- Starting a business

- Saving for a wedding

Long-term goals (5+ years):

- Saving for retirement

- Funding children’s education

- Achieving financial independence

- Building generational wealth

Within these time frames, you can set various types of goals:

- Savings goals: Accumulating specific amounts for future needs or wants

- Debt reduction goals: Paying off credit cards, loans, or mortgages

- Income goals: Increasing your earnings through career advancement or side hustles

- Investment goals: Growing your wealth through strategic investing

- Spending goals: Budgeting for major purchases or lifestyle changes

- Financial security goals: Creating safety nets like insurance and estate planning

The Benefits of Using a Printable Template

Here are the key benefits of using a printable template for financial goals:

Tangibility:

- Physical reminders keep goals present in daily life

- Tactile interaction can increase engagement and commitment

- Easy to display in prominent places (e.g. fridge, desk)

Customization:

- Adapt templates to fit personal financial situations and goals

- Add or remove sections as needed

- Personalize design elements for increased motivation

Accessibility:

- No need for digital devices or an internet connection

- Available anytime for quick reference or updates

- Useful for those who prefer non-digital tools

Focus and clarity:

- Eliminates digital distractions

- Encourages dedicated time for financial planning

- Helps distill complex financial information into key points

Cost-effective:

- Often free to download and print

- No subscription or software fees

- Easy to create multiple copies or versions

Portability:

- Carry to meetings with financial advisors

- Use during budget discussions with family members

- Take notes or make adjustments on-the-go

How Can a Printable Template Help You Stay Organized?

A printable template can significantly enhance your organization by:

- Providing structure: It offers a pre-designed framework to capture and arrange your financial information.

- Centralizing information: All your goals, progress, and plans are in one accessible place.

- Visualizing progress: Templates often include progress-tracking elements, making it easy to see how far you’ve come.

- Encouraging regular review: Having a physical document reminds you to update and assess your goals periodically.

- Simplifying complex information: Well-designed templates break down financial data into manageable sections.

What Are the Key Features of an Effective Template?

An effective financial goal template typically includes:

- Clear goal statements: Space to articulate specific, measurable goals.

- Timeframes: Sections for short-term, medium-term, and long-term goals.

- Action steps: Areas to list concrete actions needed to achieve each goal.

- Progress tracking: Visual elements like charts or checkboxes to monitor advancement.

- Financial overview: Sections for current income, expenses, and net worth.

- Milestone markers: Points to celebrate progress along the way.

- Flexibility: Room for adjustments as circumstances change.

- Prioritization: A way to rank goals by importance or urgency.

Can a Template Improve Your Motivation and Accountability?

Yes, a template can boost motivation and accountability in several ways:

- Visual reminders: Having your goals visible keeps them at the forefront of your mind.

- Tangible progress: Seeing your advancements on paper can be highly motivating.

- Commitment device: Writing down goals increases your commitment to achieving them.

- Regular check-ins: Templates encourage consistent review, enhancing accountability.

- Shared accountability: You can easily share your template with a partner or financial advisor for added support.

- Goal clarity: Well-structured templates help clarify your objectives, making them feel more achievable.

- Celebrating successes: Marking off completed goals or milestones provides a sense of accomplishment.

- Identifying obstacles: Templates can help you spot and address challenges more quickly.

How to Create Your Own Financial Goals Template

Here’s a step-by-step guide on how to create your own financial goals template:

Choose a format:

- Spreadsheet (e.g., Excel, Google Sheets)

- Digital document (e.g., Word, Google Docs)

- Physical notebook or planner

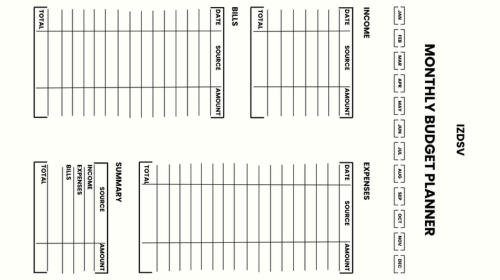

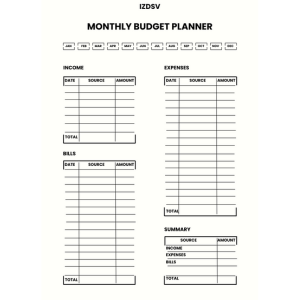

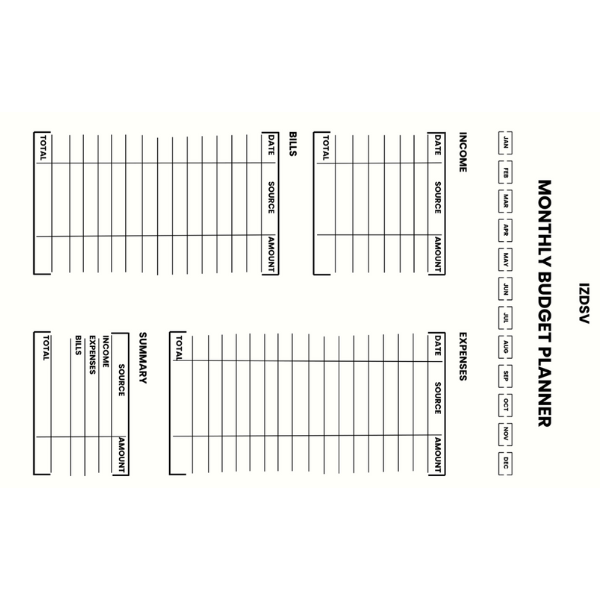

Set up main categories:

- Income

- Expenses

- Savings

- Investments

- Debt repayment

Create timeframe sections:

- Short-term goals (1-2 years)

- Medium-term goals (3-5 years)

- Long-term goals (5+ years)

Add specific goal categories:

- Emergency fund

- Retirement savings

- Home purchase

- Education

- Travel

- Major purchases

Include columns for:

- Goal description

- Target amount

- Current amount

- Target date

- Progress tracking (percentage or visual)

Incorporate a monthly budget section:

- List income sources

- Categorize expenses

- Calculate net savings

Add a review and adjustment section:

- Monthly check-in

- Quarterly review

- Annual goal reassessment

Consider adding motivational elements:

- Vision board space

- Milestone rewards

- Quotes or affirmations

Ensure flexibility:

- Leave room for new goals

- Allow for goal prioritization changes

Include a resources section:

- Financial tools and apps

- Important account information

- Professional contacts (e.g., financial advisor)

What Sections Should You Include in Your Template?

Sections to include:

- Income

- Expenses

- Savings goals

- Debt repayment

- Investments

- Short-term goals (1-2 years)

- Medium-term goals (3-5 years)

- Long-term goals (5+ years)

- Emergency fund

- Retirement planning

How Can You Customize Your Template to Fit Your Needs?

Customizing your financial goals template to fit your needs is crucial for its effectiveness. Here’s how you can tailor it:

Personalize categories:

- Add or remove sections based on your financial situation

- Create subcategories for more detailed tracking

Adjust timeframes:

- Modify goal periods to align with your life plans

- Set custom milestones for long-term goals

Incorporate your values:

- Add categories for charitable giving or ethical investing

- Prioritize goals that align with your personal values

Customize tracking methods:

- Use visual elements like charts or progress bars

- Implement color-coding for different goal types or priorities

Add automation:

- Set up formulas to calculate progress automatically

- Link to your bank accounts for real-time updates (if using digital tools)

Include accountability measures:

- Add a section for an accountability partner

- Create reminders for regular check-ins

Tailor to your income structure:

- Adjust for irregular income if you’re self-employed

- Account for bonuses or commission-based pay

Reflect your lifestyle:

- Include categories for hobbies or passion projects

- Add sections for anticipated life changes (e.g., starting a family)

Integrate with other planning tools:

- Link to your calendar for payment due dates

- Connect with your to-do list for financial tasks

Adapt to your preferred level of detail:

- Make it as simple or complex as you’re comfortable managing

- Include space for notes or explanations if you like detailed records

What Tools or Software Can You Use to Create a Template?

Tools of software you can use to create a template:

- Spreadsheet applications (Excel, Google Sheets)

- Budgeting apps (YNAB, Mint)

- Note-taking apps (Evernote, OneNote)

- Project management tools (Trello, Asana)

- Personal finance software (Quicken, Personal Capital)

Using the Template to Set and Track Goals

How Do You Set Realistic Financial Goals?

Setting realistic financial goals involves:

Assessing your current situation:

- Review your income, expenses, assets, and debts

- Understand your financial habits and patterns

Using the SMART criteria:

- Specific: Clearly define what you want to achieve

- Measurable: Quantify your goals (e.g., specific dollar amounts)

- Achievable: Ensure goals are within reach given your resources

- Relevant: Align goals with your values and long-term vision

- Time-bound: Set deadlines for each goal

Prioritizing goals:

- Rank goals by importance and urgency

- Balance short-term needs with long-term aspirations

Breaking down larger goals:

- Divide big goals into smaller, manageable milestones within goal worksheet

- Create action steps for each milestone

What Metrics Should You Track in Your Template?

Key metrics to track include:

Goal progress:

- Percentage of goal achieved in your printable goal tracker

- Amount saved or debt paid off

Financial ratios:

- Savings rate (savings/income)

- Debt-to-income ratio

- Net worth growth

Behavioral metrics:

- Frequency of budget reviews

- Number of unnecessary expenses avoided

Income and expenses:

- Monthly income changes

- Expense categories and trends

Investment performance:

- Return on investments

- Asset allocation

Debt reduction:

- Total debt payoff amount

- Interest paid over time

How Often Should You Review and Update Your Goals?

The frequency of reviews depends on the nature of your goals, but generally:

Regular check-ins:

- Weekly: Review expenses and short-term goal progress

- Monthly: Assess overall budget and adjust as needed

Quarterly deep dives:

- Review progress on all goals

- Analyze financial ratios and metrics

- Make larger adjustments if necessary

Annual comprehensive review:

- Evaluate yearly progress

- Set new goals or adjust existing ones

- Update long-term financial plans

Life event triggers:

- Major changes (job, marriage, children) warrant immediate review of printable budget planner

Market condition changes:

- Significant economic shifts may require goal adjustments

Remember to:

- Be flexible and willing to adjust goals as circumstances change

- Celebrate achievements, no matter how small

- Use reviews as learning opportunities to refine your financial strategies

Common Challenges and How to Overcome Them

What Are Some Common Obstacles to Achieving Financial Goals?

Lack of clarity:

- Vague or unrealistic goals

- Not understanding the steps needed to achieve goals

Inconsistent income:

- Fluctuating earnings making planning difficult

- Seasonal or gig work creating unstable cash flow

Unexpected expenses:

- Emergency costs derailing savings plans

- Major life events causing financial setbacks

Debt burden:

- High-interest payments slowing progress

- Multiple debts creating overwhelm

Lifestyle inflation:

- Increased spending as income grows

- Difficulty maintaining frugal habits

Lack of financial knowledge:

- Uncertainty about investment options

- Misunderstanding of financial products

Procrastination:

- Delaying important financial decisions

- Putting off saving or investing

How Can You Stay Committed to Your Financial Plan?

You can stay committed to your financial plan by:

Visualize your goals:

- Create vision boards or visual representations

- Regularly remind yourself of the “why” behind your goals

Break goals into smaller milestones:

- Celebrate small wins along the way

- Create a sense of progress and momentum

Automate finances:

- Set up automatic money saving transfers

- Use apps for budget tracking and bill tracking payments

Educate yourself:

- Read financial books or blogs on saving money

- Attend workshops or webinars on personal finance

Find an accountability partner when “Goal Setting”:

- Share goals with a trusted friend or family member

- Consider working with a financial advisor

Review progress regularly within editable worksheet:

- Schedule monthly financial check-ins

- Edit and adjust plans as needed based on progress

What Strategies Can Help You Stay on Track?

Strategies that can help you stay on track within your printable budget:

Use the envelope system:

- Allocate cash to different spending categories

- Limit spending to what’s in each envelope

Implement the 24-hour rule:

- Wait 24 hours before making non-essential purchases

- Reduces impulse buying

Practice gratitude:

- Focus on what you have, not what you lack

- Helps curb unnecessary spending

Find free or low-cost alternatives:

- Explore free entertainment options

- Use library resources instead of buying books

Increase financial literacy:

- Follow reputable financial experts on social media

- Listen to personal finance podcasts

Use positive reinforcement:

- Reward yourself (within reason) for meeting goals

- Create a visual tracker to see progress

Develop a support system:

- Join online communities focused on financial goals

- Surround yourself with like-minded individuals

Practice mindful spending:

- Ask yourself if purchases align with your goals

- Keep a spending journal to identify patterns

Create a “fun fund” in your planner template:

- Allocate a small amount for discretionary spending

- Prevents feeling deprived while staying on track

Regularly reassess and adjust your budget planner:

- Review goals quarterly to ensure they’re still relevant

- Be willing to modify strategies that aren’t working